Ric Grenell under consideration to be Trump’s point man on Ukraine: report

How to Invest in Tin Stocks (Updated 2024)

Tin has a long history as a key metal in global economic growth.

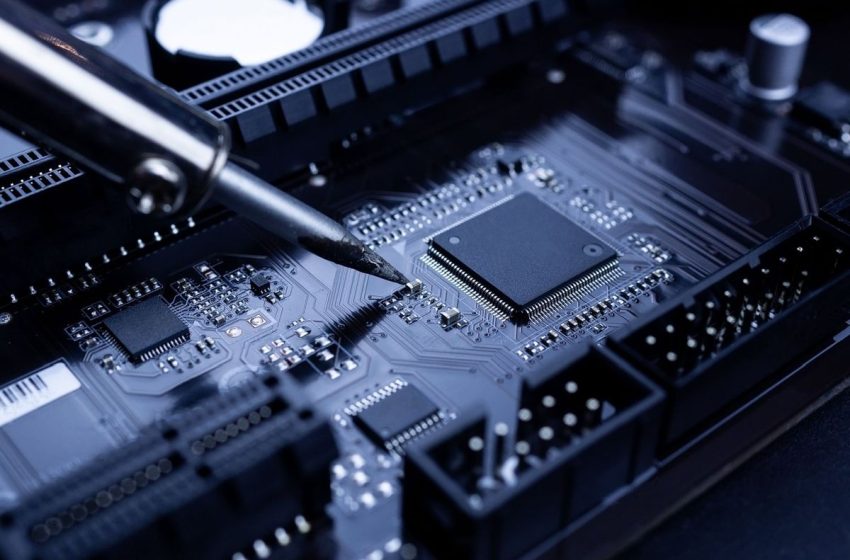

Alloyed with copper to make bronze, tin is recognized as one of the seven metals of antiquity. Today, the critical meta is ubiquitous in advanced technologies such as electric vehicles, smartphones, Internet of Things (IoT) devices, and artificial intelligence chips.

In this article

What is tin?

Tin is a silvery-white metal that is mainly found in the mineral cassiterite contained in alluvial deposits. Tin’s symbol on the periodic table of elements is Sn.

The metal can be isolated by reduction methods, which involve the removal of the oxygen molecules, with coal or coke in a smelting furnace. The result is a malleable and ductile metal that is not easily oxidized in air. It’s also lightweight, durable and fairly resistant to corrosion.

What is tin used for?

Tin’s positive characteristics mean it has a slew of important uses. Tin is primarily used to coat other metals due to its ability to retain a high polish and prevent corrosion. Tin is also an alloy metal used in soldering and the production of rare earths superconducting magnets.

Today the electronics industry is the sector to watch for investors who are keeping an eye on tin. The metal is used in semiconductor circuit-board soldering, an application that accounts for about half of global tin consumption. As electronics become more advanced, they require more semiconductor chips, and hence, more tin. AI chips are especially complex and represent an emerging source of increased demand for the metal.

‘The development of AI equipment requires the use of specialized semiconductor chips — graphic processing units (GPUs) — which use tin as both a solder and as anti-corrosion protection within circuit boards,’ according to Fastmarkets.

Tin supply and demand trends

The tin market has been in deficit for the past decade, and supply is expected to remain constrained as demand rises. This overhang alongside surging electronics demand has supported tin prices in recent years.

In addition, signs of rebounding Chinese demand and the need for tin’s soldering properties in infrastructure and AI chips are prompting bullish sentiment for the metal.

In 2024’s second quarter, these factors helped the tin price hit a two year high when it moved above US$35,000 per metric ton (MT).

Those interested in tin investing should pay attention to tin inventory changes on the London Metal Exchange (LME), as this offers insight on tin market developments. As the bullish story for tin developed at the start of 2024, speculative buying increased on the LME. This resulted in headline tin stock levels on the exchange dropping by 46 percent between the beginning of 2024 and mid-April, coinciding with the two year price high for the metal.

Of course, supply is also a big factor, and keeping an eye on supply disruptions out of important tin-producing jurisdictions is also key. Tin supply constraints from delays in export licensing in Indonesia and mining disruptions at Myanmar’s Man Maw mine contributed to the high prices seen earlier this year.

Indonesia and Myanmar are two of the biggest tin-producing countries, with output of 52,000 MT and 54,000 MT respectively. The only country with higher output in 2023 was China, the world’s top tin-producing country with output of 68,000 metric tons. Peru and the Democratic Republic of Congo (DRC) rounded out the top five with 23,000 MT and 19,000 MT, respectively.

Unsurprisingly, the world’s top tin-producing companies can be found in these countries. China’s Yunnan Tin (SZSE:000960), Peru-based private company Minsur, Indonesia’s PT Timah (IDX:TINS) and Malaysia’s Malaysia Smelting (SGX:NPW) are a few of the largest producers.

Another factor impacting supply is escalating violence in the DRC. Like tungsten, tantalum and gold, tin is a conflict mineral, and armed groups in the DRC earn hundreds of millions of dollars every year by trading these minerals.

Currently, the Dodd-Frank Act in the US requires public companies that source minerals from the DRC to produce independently audited reports about the ownership and origin of these mined commodities. these documents must be provided to the US Securities and Exchange Commission.

How to invest in tin?

As mentioned, investing in tin is becoming more and more appealing as demand for the metal grows. Tin investing can be done by buying shares of tin-focused companies and tin exchange-traded funds (ETFs) as well by taking positions in tin futures.

Tin stocks

Alphamin Resources (TSXV:AFM,OTC Pink:AFMJF).Alphamin Resources is a low-cost tin concentrate producer that has rapidly ramped up its production capacity. It operates the Bisie tin complex in the DRC, which includes the high-grade Mpama North tin mine and the newly operational Mpama South underground tin mine and concentrate plant. This tin stock also pays a dividend to shareholders twice per year.

Cornish Metals (TSXV:CUSN,LSE:CUSN)UK-based Cornish Metals’ flagship asset is the advanced-stage South Crofty tin project in Southwest England. It has existing mine infrastructure in place, as well as an active mine permit. An April 2024 preliminary economic assessment (PEA) for South Crofty shows a base case after-tax net present value of US$201 million and an internal rate of return of 29.8 percent.

Elementos ( ASX:ELT)Elementos owns two tin projects: the Cleveland tin project in Tasmania, Australia, and the Oropesa project in Spain. The company is on track to complete a definitive feasibility study for Oropesa by Q1 2025 and is aiming to bring the project into commercial production by Q4 2027.

Eloro Resources ( TSX:ELO,OTCQX:ELRRF)Eloro Resources has a portfolio of gold and base-metal properties in Bolivia, Peru and Canada. The company’s main focus is the Iska Iska project, a notable silver-tin polymetallic porphyry-epithermal complex in Southern Bolivia’s tin belt. The company is currently working on a PEA for the project, and has the option to acquire a 100 percent interest in it.

Metals X (ASX:MLX,OTC Pink:MLXEF)Metals X has a 50 percent stake in Renison, Australia’s largest tin-producing mine. Located in Tasmania, the mine produced 9,532 MT of tin in 2023. The company also holds a 22.45 percent in LSE-listed First Tin’s (LSE:1SN) Taronga tin project in Australia.

Stellar Resources (ASX:SRZ)Stellar Resources is developing its high-grade Heemskirk tin project in Western Tasmania. The company plans to power the project via renewable energy sources, including hydro and wind. A 2019 scoping study for Heemskirk highlights a 350,000 MT per annum underground mine and an on-site processing plant.

Tincorp Metals (TSXV:TINUS,OTCQX:TINFF)Tincorp Metals has a portfolio of exploration-stage projects in Bolivia and Canada. The company has two tin-focused projects in Bolivia’s tin belt: the SF Tin project and the Porvenir project. Both properties also host zinc and silver mineralization.

Tinka Resources (TSXV:TK,OTCQB:TKRFF)Tinka Resources’ flagship property is its 100 percent owned Ayawilca zinc-silver-tin project in Central Peru. The project’s Tin Zone has an estimated indicated mineral resource of 1.4 million MT grading 0.72 percent tin and an inferred mineral resource of 12.7 million MT grading 0.76 percent tin. The company released an updated PEA for the project in February 2024.

Tin futures

Those wishing to begin tin investing may want to consider tin futures, a derivative instrument tied directly to the price of the actual metal, are another option for those interested in aluminum investing. Futures are a financial contract between an investor and a seller. The investor agrees to purchase an asset from the seller at an agreed-upon price based on a date set in the future.

Rather than intending to take possession of the material asset, investors speculating in the futures market are instead making bets on whether the price of a particular commodity will rise or fall in the near future.

For example, if you buy a tin futures contract believing the price of metal is set to rise, and your prediction proves correct, you could gain a return on your investment by selling the now more valuable futures contract before it expires. However, be advised that trading futures contracts is not for the novice investor.

Traded under the code SN, an LME Tin futures contract is for 5 metric tons with contract pricing in US dollars per MT. Clearable currencies include the US dollar, yen, pound and euro.

Tin ETFs

There is only one tin-focused ETF available on Western exchanges, the WisdomTree Tin (LSE:TINM) ETF. Listed on the LSE, the WisdomTree Tin fund is an exchange-traded commodity designed to give investors total return exposure to tin futures. The fund tracks the Bloomberg Tin Subindex plus a collateral return.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.