Rob McEwen: Gold to Go “Much Higher,” Mining Stock Mania Not Here Yet

LaFleur Minerals Commences Diamond Drilling at the Swanson Gold Deposit and Completes Independent Valuation of the Beacon Gold Mill

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) (‘LaFleur Minerals’ or the ‘Company’) is pleased to announce that it has commenced its diamond drilling program at its Swanson Gold Project (‘Swanson’) in the Abitibi region, Québec, after receiving all the necessary permits including the Authorization to Intervene (ATI) and the Forestry Intervention permits. These permit approvals mark a major milestone, allowing the Company to move forward with its fully funded, minimum 5,000 metre drilling program starting with the Swanson Gold Deposit. Simultaneously, the Company announces the completion of the independent valuation of its Beacon Gold Mill (‘Beacon Mill’) by Bumigeme Inc. (‘Bumigeme’) confirming: (1) the Beacon Mill is in excellent condition, (2) with rehabilitation and commissioning costs estimated at C$4.1 million, and (3) full replacement cost of the mill and tailings storage facility combined with permitting costs estimated to exceed C$71.5 million, underscoring the strategic value of the asset. LaFleur Minerals has also significantly expanded its land position at its wholly-owned Swanson Gold Project, now covering over 18,300 hectares across 445 claims and 1 mining lease, reinforcing its district-scale exploration potential.

These recent developments mark a major operational inflection point for LaFleur Minerals:

-

Aggressive Drilling and Land Expansion: The start of a fully funded 5,000-metre drilling campaign and a significant land expansion within the Swanson Gold Project unlocking substantial discovery potential.

BUMIGEME VALUATION COMPLETE

Independent mining engineering firm Bumigeme has completed its full evaluation of the Company’s Beacon Mill in Val-d’Or, Québec and concluded that the mill is in excellent condition with anticipated rehabilitation and re-commissioning costs of C$4.1 million as part of its planned restart program. Furthermore, Bumigeme estimated the replacement CAPEX cost to build a new similar gold mill today at C$49.5 million. This cost does not include the building of a new tailings storage facility (TSF) including a tailings pond, finishing basin, piping, pumping station, etc., which is estimated at C$12 million, and mining and environmental studies and permitting costs estimated at C$10 million. Bumigeme also estimates it would take a minimum of 18 months to build a new mill and TSF, in addition to a minimum of 5 years to complete all required studies and receive all necessary permits from the federal, provincial, and municipal governments, and local and Indigenous communities prior to construction. The results of this independent valuation confirm the strong value and incredible opportunity the Beacon Mill offers for future milling of gold deposits in the Abitibi region after re-commissioning work is complete. The results of the Bumigeme evaluation will also be incorporated into the Company’s ongoing work towards a Preliminary Economic Assessment (PEA) for the Swanson Gold Project.

The Company’s next immediate priority is to secure the necessary financing to complete the rehabilitation and re-commissioning of the Beacon Gold Mill with the aim to complete the mill restart program by early 2026.

DIAMOND DRILLING COMMENCES AT SWANSON

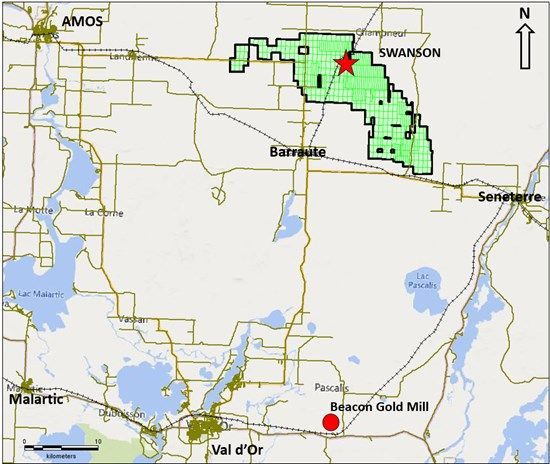

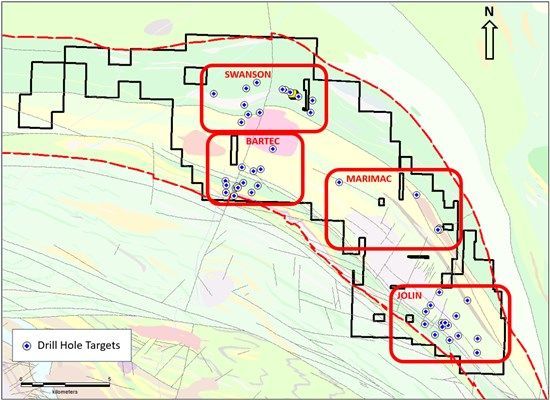

The diamond drilling program at the Swanson Gold Project (Figure 1) will focus on priority target areas including the Swanson Gold Deposit, as well as Bartec, Jolin, and Marimac target areas (Figure 2). These high-potential zones were selected following an extensive compilation of historical data and recently completed detailed exploration work by LaFleur Minerals, including:

-

High-resolution airborne magnetic and VLF-EM surveys

-

Prospecting and soil geochemistry surveys

-

Induced polarization (IP) survey program

Drilling has already commenced at the Swanson Gold Deposit and will test key structural, geological, geochemical and geophysical anomalies for additional gold mineralization potential along strike. The Company looks forward to sharing additional details and drilling assay results in the coming weeks.

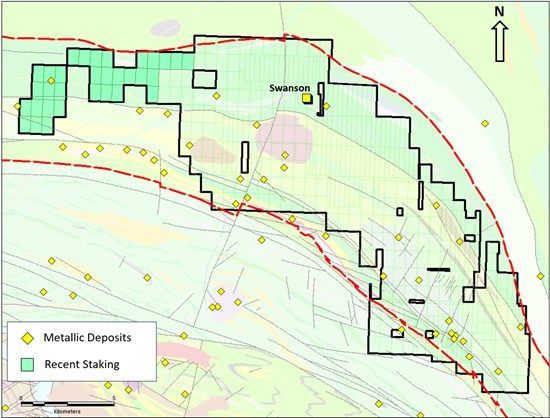

ADDITIONAL CLAIM STAKING AT SWANSON

The Company is also pleased to announce it has recently staked an additional 32 mineral claims, covering approximately 1,824 hectares, on strike and to the northwest of the Swanson Gold Deposit (Figure 3). This claims expansion extends the project’s coverage of favourable geology to over 33 kilometres of strike length, significantly enhancing Swanson’s exploration potential. The Swanson Property represents one of the largest land and mineral packages in the renowned southern Abitibi Gold Belt, which hosts favourable geology and mineralized structures. The Swanson Gold Project now includes 445 mineral claims and 1 mining lease covering a total of 18,304 hectares, positioning it as a key district-scale gold exploration play on a project that hosts over 36,000 metres of historical drilling and multiple high potential drill targets.

Paul Ténière, CEO of LaFleur Minerals stated, ‘We are very pleased with results of the full evaluation of the Beacon Gold Mill by Bumigeme and it truly shows the incredible potential of this milling asset as we advance towards becoming a near-term gold producer. Our technical team has also done an exceptional job integrating historical exploration data with new geophysical and geochemical datasets to define compelling drilling targets at Swanson. Receiving the required permits clears the way for us to advance one of the most exciting exploration and drilling campaigns in the region. Not only are we launching a fully funded, data-driven drilling program, but we’ve also strategically expanded our land position in a way that meaningfully increases our discovery potential.‘

Figure 1: Swanson Deposit – 50 km from the Beacon Gold Mill

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/259175_463e41b81478eb51_001full.jpg

Figure 2: Swanson drilling target regions and proposed 2025 drill holes (in blue)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/259175_463e41b81478eb51_002full.jpg

Figure 3: Recent staking at Swanson

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/259175_463e41b81478eb51_003full.jpg

QUALIFIED PERSON STATEMENT

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo. (OGQ), Exploration Manager and Technical Advisor of the Company and considered a Qualified Person for the purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d’Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is approximately 18,304 hectares (183 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road allowing direct access to several nearby gold mills, further enhancing its development potential. LaFleur Minerals’ fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LaFleur Minerals INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding ‘Forward-Looking’ Information

This news release includes certain statements that may be deemed ‘forward-looking statements’. All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words ‘expects’, ‘plans’, ‘anticipates’, ‘believes’, ‘intends’, ‘estimates’, ‘projects’, ‘potential’ and similar expressions, or that events or conditions ‘will’, ‘would’, ‘may’, ‘could’ or ‘should’ occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259175

News Provided by Newsfile via QuoteMedia