5 wild ways Democrats have embraced the Monty Python strategy of politics

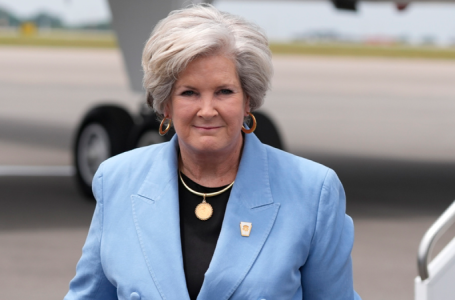

Tracy Shuchart: Energy Demand Exploding — Watching Oil/Gas, Uranium and Grid Stocks

Tracy Shuchart, CEO and founder of Hilltower Resource Advisors, discussed the growing need for all types of energy in the US, saying she’s looking for opportunities in oil, natural gas, grid stocks and uranium juniors.

‘I think 2025 is going to be a really good year for energy, absolutely,’ she said. ‘Not just because of the incoming administration that is very pro-energy and very-pro nuclear as well. But I think with this demand explosion that we’re having it’s going to be hard to keep ignoring that sector as people have over the last few years.’

Looking at oil stocks, Shuchart said those who do their research will be able to find bargains outside the majors.

‘The Exxon Mobils (NYSE:XOM), the Chevrons (NYSE:CVX) — they’re always going to perform well. But if you want to take on a little bit more risk, you can look at some of those smaller producers that maybe haven’t performed as well.’

When it comes to natural gas, she said she’s looking at midstream companies due to the growing need for pipelines.

Shuchart is also interested in grid stocks as power demand from artificial intelligence data centers increases.

Those include utilities companies like Southern Company (NYSE:SO), as well as equipment stocks like Siemens (OTC Pink:SMAWF,ETR:SIE), LG Electronics (KRX:066570) and Hitachi (TSE:6501).

In the uranium sector, Shuchart is focused on North American juniors.

‘They’ve been underperforming some of the majors, but now that we’ve had uranium prices kind of hold this US$80, US$85 (per pound) area for a long enough time, that’s enough money that they can be successful,’ she said.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.